Infrastructure lies at the heart of Africa’s story. It is the backbone of competitiveness, industrialisation, and integration. Roads, ports, energy systems, and digital grids determine whether opportunities can flourish or are suffocated.

By Carlos Lopes, Professor at the University of Cape Town’s Nelson Mandela School of Public Governance and Board Chair at the African Climate Foundation

READ TIME: 5 MIN

Key takeaways:

1. Infrastructure must be aligned with a long-term vision.

2. The quality of infrastructure matters as much as its quantity.

3. Africa can leapfrog traditional infrastructure models and mobilise domestic capital sources.

In Africa, infrastructure is the currency of transformation – without it, trade integration under the African Continental Free Trade Area (AfCFTA) will remain a slogan, industrialisation will falter, and the much-discussed demographic dividend will be at risk of becoming a demographic debt.

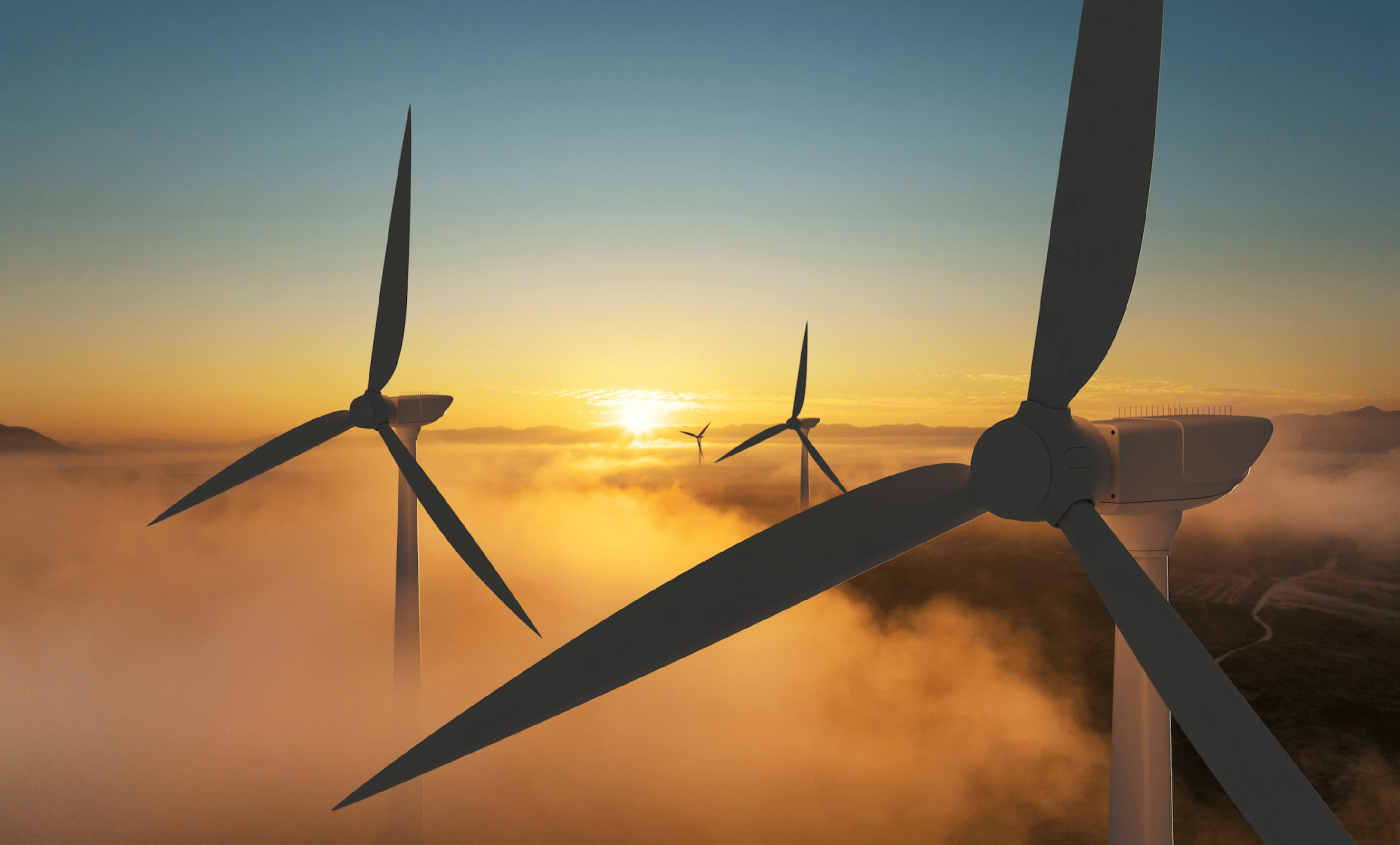

Just as importantly, without green infrastructure, Africa risks building a future already out of sync with the climate realities of the 21st century.

Infrastructure is about strategic choices

Other emerging economies remind us that infrastructure has never been about concrete and steel alone. It is about strategic choices, aligning investment with a long-term vision, and making the state an enabler, not an obstacle.

Brazil’s decision to invest in logistics corridors did not simply reduce transport times; it reshaped trade flows and created confidence that the country could integrate more deeply into regional and global markets.

India’s embrace of public-private partnerships (PPPs) combined with digital monitoring tools not only accelerated road and renewable energy projects, but sent a signal that delivery is possible even in a complex governance environment.

Türkiye’s carefully designed PPP frameworks in transport and health infrastructure gave investors the confidence to enter markets they had long considered too risky.

And China’s special economic zones show how a single city like Shenzhen can become not just a factory for exports, but a laboratory for reform far beyond the zone itself.

Climate-aware industrial strategies are needed

Too often, our infrastructure programmes are conceived as discrete projects, negotiated bilaterally, and measured in terms of immediate costs rather than long-term multipliers.

If Africa wants infrastructure to become transformative, it must be integrated into a broader continental industrial strategy that cannot ignore climate change. It has to be climate-smart, low-carbon, and resilient to rising risks, from droughts and floods to supply-chain disruptions.

In this sense, infrastructure is a political choice about the kind of economy Africa wants to build – one locked into fossil dependency or one that positions itself at the forefront of the green transition.

Infrastructure quality matters as much as quantity

Infrastructure’s impact is already clear. The African Development Bank estimates that more than half of Africa’s growth acceleration in recent years can be attributed to infrastructure investment.

Where energy, transport, and communications systems are reliable, industrial capacity and employment follow. When they are absent, the opportunity costs are staggering.

Key takeaways:

1. Infrastructure must be aligned with a long-term vision.

2. The quality of infrastructure matters as much as its quantity.

3. Africa can leapfrog traditional infrastructure models and mobilise domestic capital sources.

For instance, the World Bank has calculated that unreliable electricity alone reduces Africa’s GDP growth by around two percentage points per year. A coal-based power plant may provide power, but will leave stranded assets in a decarbonising global economy.

By contrast, investing in renewables simultaneously secures jobs, trade competitiveness, and resilience.

Africa’s demographic dividend hangs in the balance

Demographics add urgency. By 2050, Africa will have nearly 2.5 billion people, half under the age of 25. This young population will either become the engine of the world’s growth or the epicentre of its instability.

Much will depend on whether infrastructure is scaled to meet their needs. Without energy grids to power new industries, roads to connect farmers to markets, ports to handle trade flows, and digital backbones to create jobs, the promise of a demographic dividend will dissipate.

And without climate-resilient infrastructure, hard-won gains will be washed away by the next flood or cyclone.

Infrastructure is literally the bridge between demography and destiny.

Domestic capital is indispensable for success

Brazil, India, and Türkiye all realised that domestic capital mobilisation was indispensable. Pension funds, sovereign wealth funds, and insurance markets became anchors of long-term financing complemented by external investors.

Nigeria, Kenya, and South Africa manage pension assets worth billions of dollars. With appropriate regulation, governance, and instruments, these funds could become the backbone of infrastructure finance.

Crucially, they could be channelled into green bonds, climate funds, and blended finance vehicles that align with the continent’s climate commitments while providing attractive, stable returns.

This is critical as traditional development assistance shrinks.

Partnerships should be leveraged to unlock blended finance, de-risking instruments, and climate-aligned guarantees to crowd in private capital.

The litmus test will be whether they reinforce African ownership and align with continental priorities or imitate fragmented donor-driven agendas.

The African Union’s Agenda 2063 has set the vision of an integrated, resilient, prosperous continent built on infrastructure that serves growth, inclusion and sustainability. The challenge is not in the aspiration, but in the execution.

For that, we must treat other emerging economies not simply as role models, but as interlocutors. They provide mirrors of what to emulate and what to avoid, but also the opportunity for partnerships rooted in common challenges.

How infrastructure will shape Africa’s destiny

In the end, infrastructure will decide whether or not Africa’s economic promise becomes reality. It will determine whether the AfCFTA is a transformative marketplace or a missed opportunity. It will shape whether Africa’s young population becomes a demographic dividend or a destabilising force. And it will decide whether the continent is seen as peripheral or as a partner in the global economy.