read time 8min

numbers

don't

lie...

…except when they do.

But people tend to tell the truth, especially when you ask them what it’s really like doing business in Africa.

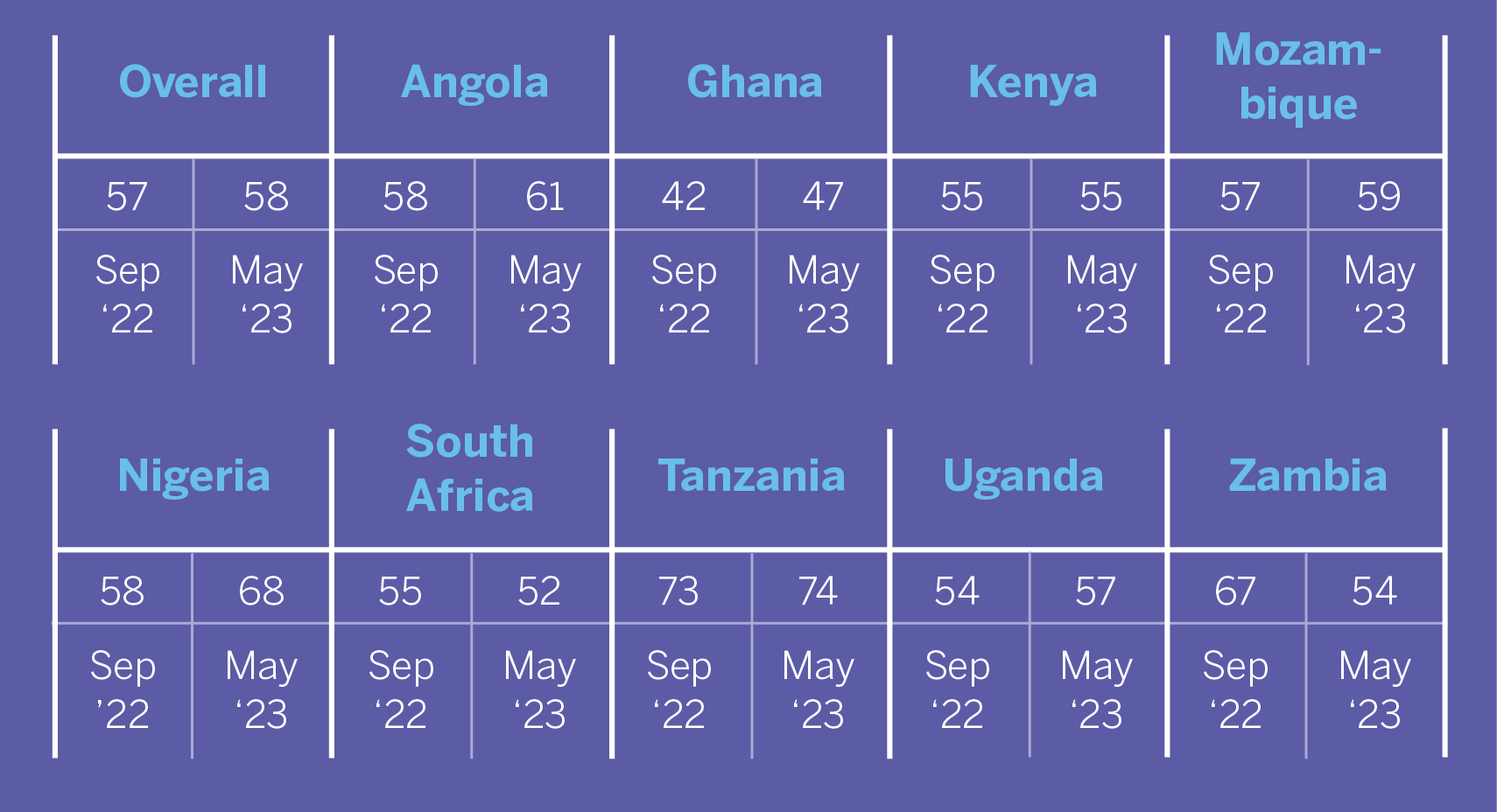

Trade barometer

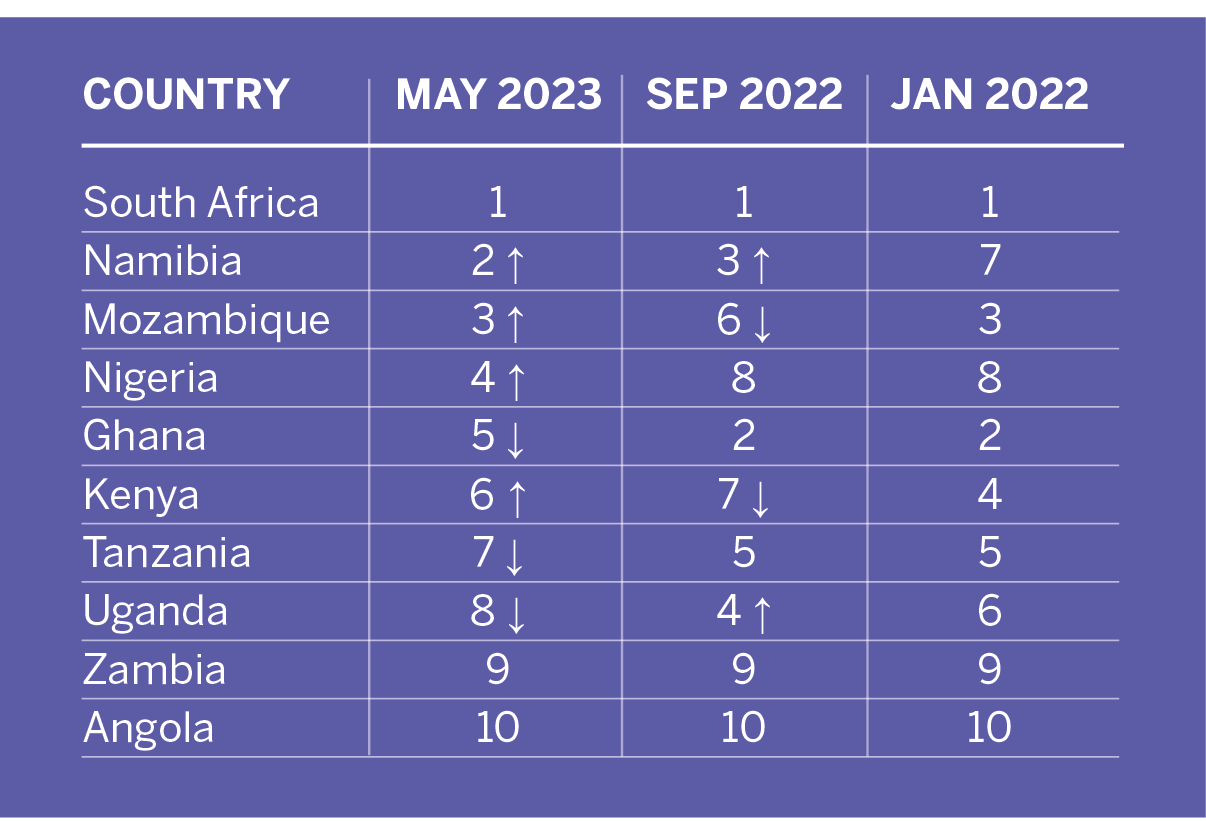

Created by the Standard Bank Group as Africa’s leading trade index, the Standard Bank Africa Trade Barometer provides a nuanced view of the state of business in Africa. It focuses on 10 key sub-Saharan African economies: major players South Africa, Nigeria and Kenya, up-and-comers Ghana, Tanzania and Mozambique, and regional bellwethers Namibia, Angola, Uganda and Zambia. What is the mood of business in these economies? What are the barriers to trade and how do the people on the ground – the entrepreneurs, small business owners, white-collar managers and C-suite execs – feel about doing business in Africa? The third edition, published in September 2023, surveyed 2 636 businesses across the corporate (13%), large business (19%) and small business (68%) spaces. Through their responses, a picture emerges of a continent in flux; one where yesterday’s mood often (but not always) reflects today’s operating reality.

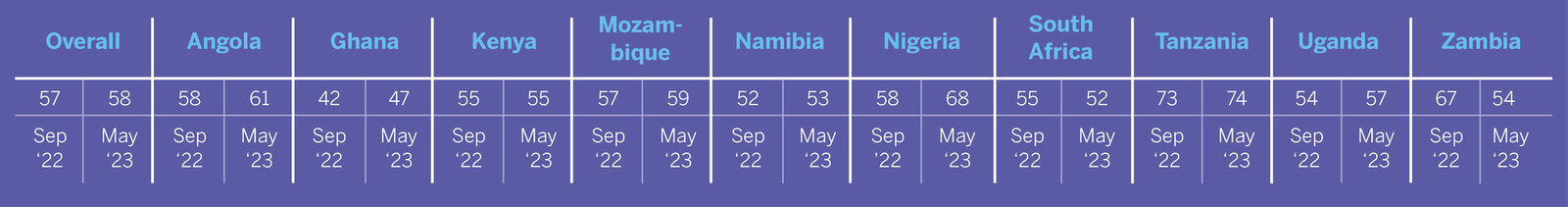

HOW THEY RANKED FOR TRADABILITY*

Download the third edition of Standard Bank’s Africa Trade Barometer.

Africa is open for business, with a sense of cautious post-pandemic optimism blooming across the continent. “There has been a rebound from some of the supply chain constraints which first arose during the Covid-19 pandemic,” says Justin Milo, Executive Head: Trade, South Africa at Standard Bank Corporate and Investment Banking. “Trade is returning to normal levels, and we are hearing less from our clients around critical shortages of key inputs into their production processes.”

In line with the alleviation of those supply constraints, Milo says that African businesses are increasingly looking at opportunities for growth. “That growth is reliant on them having access to working capital funding,” he says. “There has been an increase in the demand for working capital funding – and that cuts across both traditional working capital funding as well as more structured solutions such as supply chain finance.”

However, some challenges remain. “While the majority of the 10 countries examined have recorded strong economic growth following the Covid-19 pandemic, most face a volatile global environment characterised by tightening global financial conditions, the impact of Russia’s invasion of Ukraine, lacklustre global growth and persistent climate threats,” says Philip Myburgh, Standard Bank’s Head of Trade & Africa-China Banking, Business and Commercial Banking.

Milo agrees. “We’re seeing an increase in the perceived risk of trading in Africa,” he says. “But that needs to be seen against the

backdrop of the global economy – with subdued growth, sticky inflation and high interest rates, as well as foreign currency liquidity challenges across a number of African markets. Generally, suppliers and exporters of products into Africa are worried about payment risk. If they supply goods, will they get paid? We’ve also seen credit rating downgrades in several markets, so many clients are looking for solutions to help them mitigate their payment risk exposure to African counterparties.”

fast facts

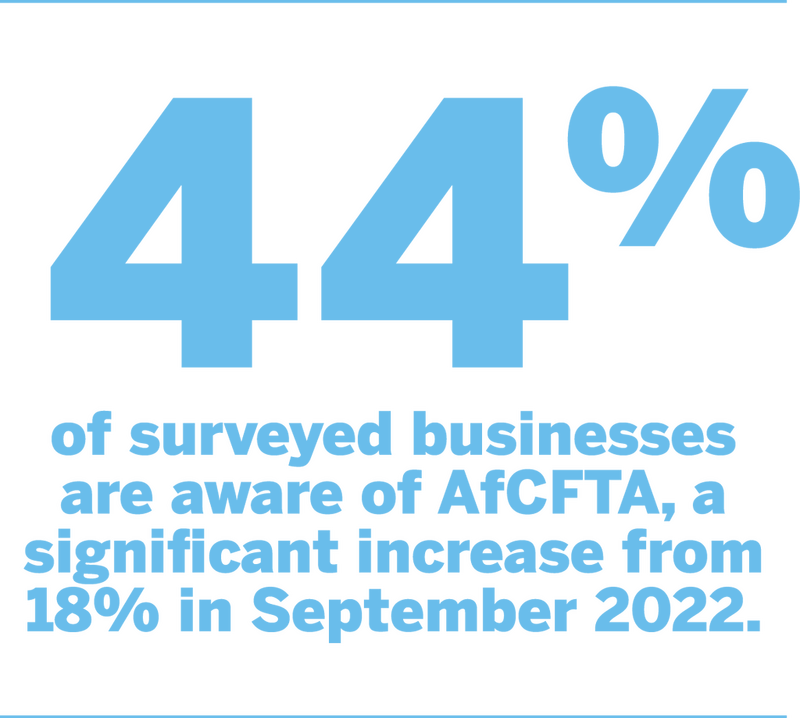

“AfCFTA is relevant, it’s very necessary and it’s a positive step,” says Milo, echoing the sentiments of many Standard Bank Africa Trade Barometer survey respondents. “Intra-Africa trade historically has been lower than one might have hoped or expected, considering the geographic proximity of the various markets. African businesses tend to trade more with counterparties from non-African markets – such as China, Europe and the US for example. There’s nothing wrong with that, but there is merit in fostering increased regional trade and economic development on the continent. The African Continental Free Trade Area is one way in which that can be achieved, by removing the tariff barriers to intra-Africa trade.”

The AfCFTA entered into force on 30 May 2019 and – after a delay caused by the pandemic – trading under the agreement started on 1 January 2021. It’s been a slow start, though.

“Intra-Africa trade has not responded immediately to the AfCFTA,” says Milo, “but there are certain constraints that countries face. These include infrastructure backlogs and challenges; the trade finance gap and industrial policy challenges.”

Infrastructure constraints present both a challenge and an opportunity. “While it is theoretically possible to trade between

specific African countries, if the road, rail and port infrastructure doesn’t allow it, it becomes a moot point,” says Milo. “But that in itself is also an opportunity. As an African bank, Standard Bank is well placed to assist with financing and banking solutions for infrastructure projects that will pave the way for greater intra-Africa trade and contribute towards the development of the continent”.

As far as trade financing goes, Milo notes that there is a widely publicised “trade finance gap” where the demand for trade finance exceeds the supply of this funding. “With local market knowledge and deep expertise, Standard Bank is playing an active role in reducing the trade finance gap as a major provider of trade finance in Africa. In cases where the risk is perceived to be high, there is a role for banks to collaborate with other banks and development finance institutions to reduce the trade finance gap through the sharing of risk.”

Industrial policy is another opportunity wrapped within a challenge. “Certain countries specialise in specific export industries, and it would require deliberate policy interventions by certain markets to decide which export industries they would like to support,” Milo explains. “That support might come in the form of subsidies, or it might be in certain incentives or the alleviation of other constraints in order to boost the export capacity of certain African countries.”

TEXT: Mark van Dijk

Created by the Standard Bank Group as Africa’s leading trade index, the Standard Bank Africa Trade Barometer provides a nuanced view of the state of business in Africa. It focuses on 10 key sub-Saharan African economies: major players South Africa, Nigeria and Kenya, up-and-comers Ghana, Tanzania and Mozambique, and regional bellwethers Namibia, Angola, Uganda and Zambia. What is the mood of business in these economies? What are the barriers to trade and how do the people on the ground – the entrepreneurs, small business owners, white-collar managers and C-suite execs – feel about doing business in Africa? The third edition, published in September 2023, surveyed 2 636 businesses across the corporate (13%), large business (19%) and small business (68%) spaces. Through their responses, a picture emerges of a continent in flux; one where yesterday’s mood often (but not always) reflects today’s operating reality.

HOW THEY RANKED FOR TRADABILITY*

Africa is open for business, with a sense of cautious post-pandemic optimism blooming across the continent. “There has been a rebound from some of the supply chain constraints which first arose during the Covid-19 pandemic,” says Justin Milo, Executive Head: Trade, South Africa at Standard Bank Corporate and Investment Banking. “Trade is returning to normal levels, and we are hearing less from our clients around critical shortages of key inputs into their production processes.”

In line with the alleviation of those supply constraints, Milo says that African businesses are increasingly looking at opportunities for growth. “That growth is reliant on them having access to working capital funding,” he says. “There has been an increase in the demand for working capital funding – and that cuts across both traditional working capital funding as well as more structured solutions such as supply chain finance.”

However, some challenges remain. “While the majority of the 10 countries examined have recorded strong economic growth following the Covid-19 pandemic, most face a volatile global environment characterised by tightening global financial conditions, the impact of Russia’s invasion of Ukraine, lacklustre global growth and persistent climate threats,” says Philip Myburgh, Standard Bank’s Head of Trade & Africa-China Banking, Business and Commercial Banking.

Milo agrees. “We’re seeing an increase in the perceived risk of trading in Africa,” he says. “But that needs to be seen against the backdrop of the global economy – with subdued growth, sticky inflation and high interest rates, as well as foreign currency liquidity challenges across a number of African markets. Generally, suppliers and exporters of products into Africa are worried about payment risk. If they supply goods, will they get paid? We’ve also seen credit rating downgrades in several markets, so many clients are looking for solutions to help them mitigate their payment risk exposure to African counterparties.”

“AfCFTA is relevant, it’s very necessary and it’s a positive step,” says Milo, echoing the sentiments of many Standard Bank Africa Trade Barometer survey resp0ondents. “Intra-Africa trade historically has been lower than one might have hoped or expected, considering the geographic proximity of the various markets. African businesses tend to trade more with counterparties from non-African markets – such as China, Europe and the US for example. There’s nothing wrong with that, but there is merit in fostering increased regional trade and economic development on the continent. The African Continental Free Trade Area is one way in which that can be achieved, by removing the tariff barriers to intra-Africa trade.”

The AfCFTA entered into force on 30 May 2019 and – after a delay caused by the pandemic – trading under the agreement started on 1 January 2021. It’s been a slow start, though.

“Intra-Africa trade has not responded immediately to the AfCFTA,” says Milo, “but there are certain constraints that countries face. These include infrastructure backlogs and challenges; the trade finance gap and industrial policy challenges.”

Infrastructure constraints present both a challenge and an opportunity. “While it is theoretically possible to trade between specific African countries, if the road, rail and port infrastructure doesn’t allow it, it becomes a moot point,” says Milo. “But that in itself is also an opportunity. As an African bank, Standard Bank is well placed to assist with financing and banking solutions for infrastructure projects that will pave the way for greater intra-Africa trade and contribute towards the development of the continent”.

As far as trade financing goes, Milo notes that there is a widely publicized “trade finance gap” where the demand for trade finance exceeds the supply of this funding. “With local market knowledge and deep expertise, Standard Bank is playing an active role in reducing the trade finance gap as a major provider of trade finance in Africa. In cases where the risk is perceived to be high, there is a role for banks to collaborate with other banks and development finance institutions to reduce the trade finance gap through the sharing of risk.”

Industrial policy is another opportunity wrapped within a challenge. “Certain countries specialise in specific export industries, and it would require deliberate policy interventions by certain markets to decide which export industries they would like to support,” Milo explains. “That support might come in the form of subsidies, or it might be in certain incentives or the alleviation of other constraints in order to boost the export capacity of certain African countries.”

TEXT: Mark van Dijk