As Head of Sustainability at Standard Bank, I constantly ask myself one question: does the work we do genuinely help to make life better for Africa’s people?

MAKING THE RIGHT IMPACT

By Boitumelo Sethlatswe

read time: 3 min

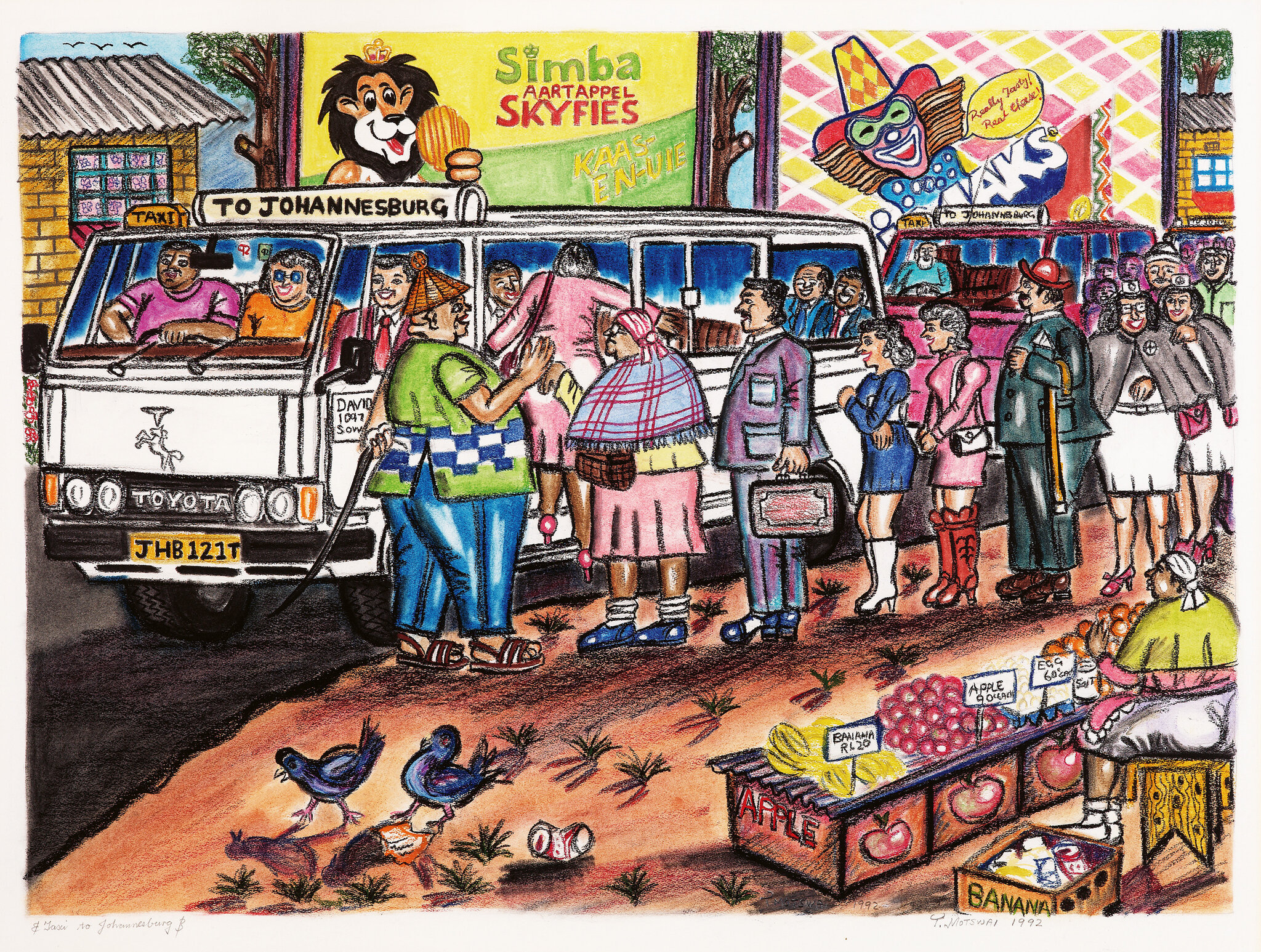

I GREW UP IN JOHANNESBURG, but often visited my grandmother in a small village in North West over the holidays. What struck me every time was the significant difference between my life and life in the community she called home. It looked as if not much had changed between visits, as if time had stood still in the village.

I often think about this, and the two South Africas I grew up in, when I speak about things like developing infrastructure and fostering financial inclusion. When discussing environmental, social and governance (ESG) issues with my global peers, the “S” is often left out as the climate crisis crowds out everything else. However, companies operating in emerging markets know that success is impossible without sustainable social infrastructure.

PUTTING SUSTAINABILITY INTO ACTION

To achieve this, we’ve identified four areas in which we believe the bank can make the greatest difference, namely financial inclusion, business growth and job creation, climate change mitigation and adaptation, and infrastructure development. In each of these areas, we aim to maximise value for our shareholders, clients and communities.

We extend access to financial services to help individuals and business owners to save, invest, plan for the future, insure what matters, and access credit to achieve their goals. We mobilise finance for the development of large-scale infrastructure development, from roads and ports to electricity and water services, social development, and economic activity. We partner with our clients to support their decarbonisation journeys and strengthen their resilience to climate risk. In all instances, we strive to create economic, social and environmental value while acknowledging that trade-offs may be needed and negotiating them to reduce their detrimental effect.

South Africa’s energy crisis, for instance, created an opportunity to play an active part in finding solutions while working to ensure a just energy transition. The kind of human development envisaged by the United Nations’ Sustainable Development Goals requires urgent action to address Africa’s massive energy deficit. At the same time, every one of us needs to take urgent action to reduce carbon emissions and protect the natural environment and ecosystems that we depend on for life. We believe it’s possible to do both. Indeed, the only way to achieve a sustainable energy transition is to simultaneously address poverty, inequality and unemployment.

By the end of 2023, the bank had financed 3 640 MW of renewable energy infrastructure in South Africa since the launch of the Renewable Energy Independent Power Producer Procurement Programme in 2011. This amounts to more than R50 billion in committed financing. On a client level, we’ve created solutions for corporate organisations that want to develop their own renewable energy solutions, easing pressure on the national grid and reducing their carbon emissions. We introduced rooftop solar solutions for small businesses and homeowners seeking a reliable power supply and lower electricity bills.

“Making a positive impact truly is a collaborative effort that has the potential to move the needle on critical challenges.”

PARTNERING TO MAKE A REAL IMPACT

I’m inspired by the progress we’ve made across the Standard Bank Group. Our sustainable finance solutions have grown from a fairly niche product area a few years ago to a diverse set of solutions developed in partnership with our clients, from governments and corporates to homeowners and entrepreneurs. I’ve seen that making a positive impact truly is a collaborative effort that has the potential to move the needle on critical challenges.

I’ve also learned that it really is up to everyone to play their part. We’re here to help businesses and individuals realise their ambitions to ultimately create social and environmental value.

This is true for colleagues from other teams too. Do what you can in your own team and in your own life. Every department has a role to play in driving our sustainability goals. The more deeply these principles are embedded into our business practices, the more tangible our impact will be.

So, to answer my own question, I am confident that we’re fulfilling our purpose, and I know we’re ready to do more.

Artwork: Taxi to Johannesburg by Tommy Motswai, 1992 Standard Bank Young Artist Award Winner for Fine Art