Better

infrastructure

better lives

It’s no secret that Africa’s infrastructure deficit frequently hinders economic growth. Still public-private partnerships drive crucial projects across the continent, aiming to boost the economic well-being of countries and their people.

read time: 7 min

By

Jonathan Muga, Global Head: Infrastructure, Standard Bank Corporate and Investment Banking

and

Zen Dlamini, Executive Head: Infrastructure, Sovereign and Public Sector, Standard Bank Corporate and Investment Banking

WHEN SPEAKING ABOUT INFRASTRUCTURE DEVELOPMENT in Africa, it’s important to see it in context. Whereas developed nations may have enviable priorities, Africa is lagging in terms of economic growth, social well-being and global competitiveness. To attain our goals on these fronts, we need the necessary infrastructure – from transport networks and energy grids to digital connectivity and water systems – to carry our hopes and dreams.

However, within this challenge lies an extraordinary opportunity. If we can get our infrastructure to a fully functional level, Africa’s GDP could potentially double from the current USD3.1 trillion.

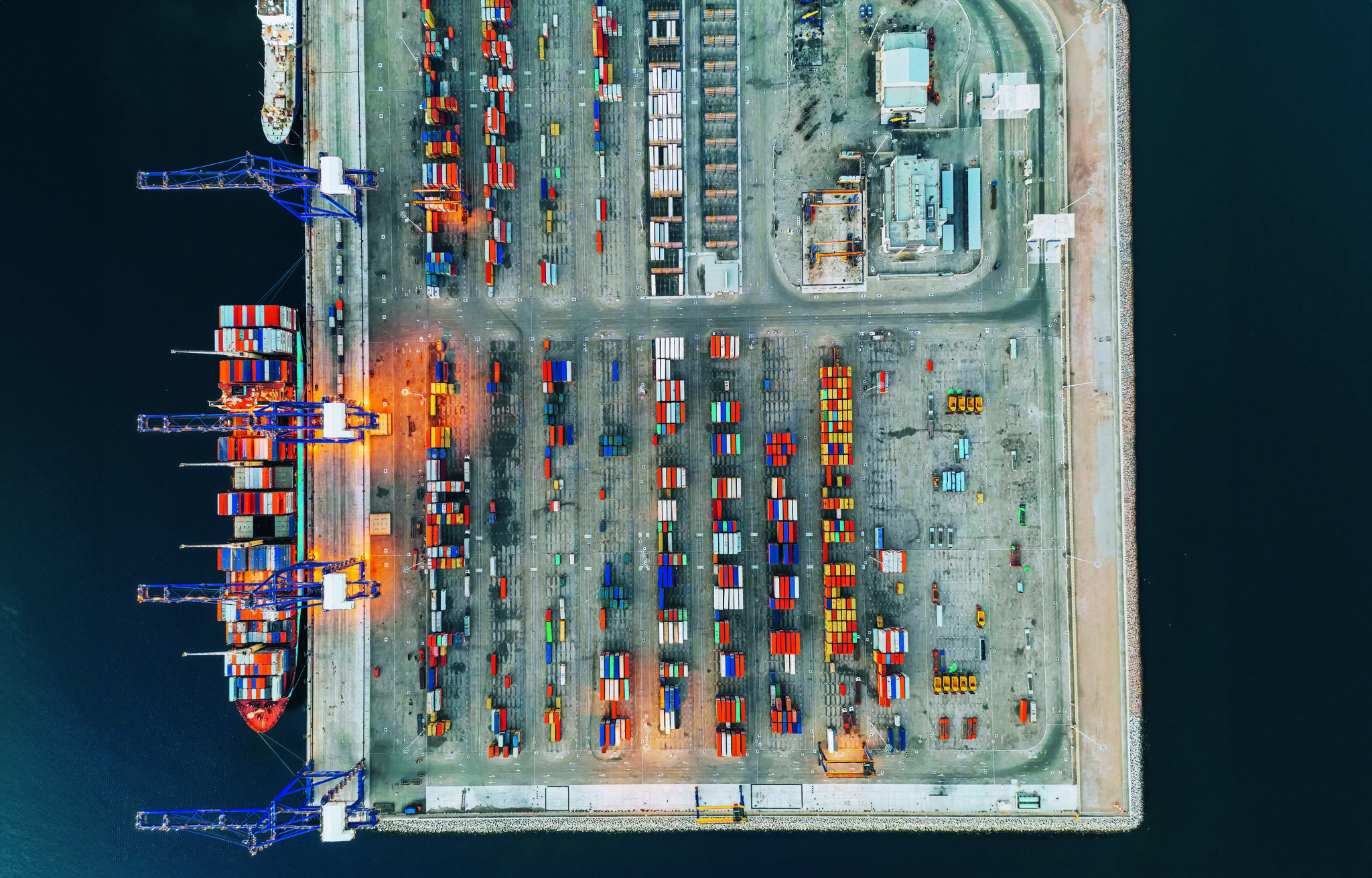

This isn’t merely theoretical – we’ve seen how strategic infrastructure investments transform regional economies. For instance, efficient port operations reduce cargo dwell times considerably, directly impacting the cost of goods and regional competitiveness. Similarly, modern rail infrastructure reduces transportation costs by up to 35% compared to road transport, creating immediate economic benefits for businesses and consumers alike.

It’s time to think differently about infrastructure development

Global Head: Infrastructure, Standard Bank Corporate and Investment Banking

Jonathan Muga

THE OPPORTUNITY IN NUMBERS

Our infrastructure challenges have not only hampered economic development, they stand as barriers to human development and social progress. The impact of this is not always easy to measure and quantify.

The economic cost, however, can be calculated. The continent has an infrastructure deficit of at least USD100 billion annually – and that’s just to address existing backlogs. Only then will it be possible to invest in growth.

Studies have shown that inadequate infrastructure reduces industrial productivity by as much as 40% on the continent. In the energy sector alone, estimates are that many African economies are losing between 1% and 4% of GDP annually due to an unreliable power supply. The water infrastructure gap is estimated to cost a further 5% of the continent’s GDP.

Water, energy and transport are typically top of mind when it comes to infrastructure. When we talk about improving healthcare delivery, we’re really talking about having reliable electricity that keeps the vaccines cold. When we discuss educational outcomes, we are also speaking about the internet connectivity that gives students access to global knowledge, as well as the safe and reliable transport systems that enable them to get to school on time.

While governments have traditionally been the primary investors in public infrastructure, the scale and complexity of today’s challenges have made it clear that public funds alone are insufficient to close the gap. In recent years, businesses, investors and multinational corporations have recognised that strategic investment in infrastructure is not only essential for long-term economic growth, but also offers substantial opportunities for innovation, returns and socio-economic impact.

“Strategic infrastructure investments transform regional economies.”

Making inroads, one step at a time

There are a number of promising signs. In Nigeria, cement companies are building roads. In the Democratic Republic of Congo (DRC), mining companies are investing in electricity infrastructure and rail networks. These efforts go beyond corporate social responsibility – they are strategic investments in operational efficiency that benefit both the business and the surrounding community. The transformation seen across Africa is most evident in our ports, where private investment is thriving. Investors are strategically positioning themselves with “one foot in the water and one foot on land” because of the crucial role sea ports play in connecting Africa to global trade routes.

While improving port infrastructure is a crucial first step, it is only the beginning. The real challenge – and opportunity – lies in developing integrated transport corridors that link ports to the interior. Their importance cannot be overstated, especially when considering the growing demand for critical minerals needed for the energy transition. The Central African Copper Belt running through the DRC and Zambia is rich in resources vital to shift to green energy. To enjoy their full benefit, we need efficient, sustainable transport systems.

Financing is just one aspect of such projects, though. For the Standard Bank Group, deals must not only make economic sense, they must also deliver social impact. When brokering agreements on this scale, preparation and prioritisation are crucial. This is reflected in the low number of proposed infrastructure projects that reach financial close in Africa. This isn’t necessarily due to insufficient capital, but rather to limited policies to support investor confidence and inadequate support during the project development phase, especially given the long lead times required.

It’s important to remember that infrastructure relates to living standards. Once they improve, local and intracontinental trade will grow. Agreements like the African Continental Free Trade Area undoubtedly present unprecedented opportunities, but their success depends entirely on our ability to connect African markets through robust infrastructure networks. After all, any system is only as strong as its weakest link.

Looking ahead, we need to think differently about how we approach infrastructure development. Public-private partnerships are no longer just an alternative – they are becoming a primary vehicle for delivering infrastructure. This shift necessitates a fresh perspective on project preparation, risk allocation and project financing.

3

NEW mega- projects

Lobito Atlantic Railway

WHAT: Upgrades to the 1 289 km railway

WHY: To connect the DRC with the Lobito port in Angola

Abidjan-Lagos Corridor highway

WHAT: Constructing a 1208 km highway

WHY: To connect Nigeria, Benin, Togo, Ghana and Côte d’Ivoire

Seriti Green wind farm

WHAT: South Africa’s largest wind farm, situated in Mpumalanga

WHY: To add to the grid in Mpumalanga with 155 MW already under construction and another 310 MW set to come online by 2027

THE NUTS AND BOLTS OF PUBLIC-PRIVATE PARTNERSHIPS

Executive Head: Infrastructure, Sovereign and Public Sector, Standard Bank Corporate and Investment Banking

Zen Dlamini

RELIABLE INFRASTRUCTURE ISN'T JUST A CONVENIENCE; it’s a prerequisite for a thriving business environment which, in turn, enables sustainable economic development.

Without it, foreign investors may look elsewhere and the ripple effect can be far-reaching, impacting trade and even driving away local entrepreneurs. For instance, Innovisa, a company that processes visas for tech entrepreneurs, reported in 2022 that around 40 Nigerian startup owners move to the UK each year. The reason? Robust ICT infrastructure and a more diverse pool of investors.

Investments of

$13bn

in port projects in Africa were the highest in the world between 2010 and 2022.

STANDARD BANK’S INFRASTRUCTURE FOCUS

The Group segments infrastructure into different categories, such as transport, construction, utilities, original equipment manufacturers, logistics and social infrastructure – the latter being assets that accommodate social services and focus on issues such as health and education.

Although active in all these sectors, our focus is on three areas in particular: transport, logistics and utilities – especially water, for obvious reasons, as the African continent, including South Africa, is water scarce.

One solution that is gaining traction in these areas is strong public-private partnerships (PPPs). They present a huge opportunity. Kumba Iron Ore, for example, has been particularly affected by logistics constraints in South Africa that throttle commodity exports. They therefore work with Transnet, the Ore User’s Forum and government through the National Logistics Crisis Committee to improve logistics performance and expedite critical projects.

The Group plays a crucial role in similar partnerships where we work closely with government entities like the Development Bank of Southern Africa. CIB has been instrumental in projects like the Lesotho Highlands Water Project, which supplies water to South Africa, and the Mokolo Crocodile Water Augmentation Project.

A public-transport project where the bank continues to play a role is the Gautrain. We have been involved since 2006 when construction first began and remain one of its biggest commercial lenders. The Gautrain revolutionised public transport in Gauteng and has transported 7.9 million passengers in the 2023/4 financial year.

Meridiam is another one of our long-term partners. The company has been building its investment credentials on the continent since 2015, especially with regards to alternative energy infrastructure. We first joined forces with them in 2020 and our most recent partnership came in 2023 when they acquired the Kenyan assets of BTE Renewables, a company that operates onshore wind and solar projects.

“We work with the right players, provide input, and see ourselves as part and parcel of the economy.”

In South Africa, President Ramaphosa signed the Electricity Regulation Amendment Act last year. It sets out far-reaching reforms of the electricity sector, including the establishment of a competitive electricity market. This Act will enable additional private sector involvement in the local energy market.

We’ve also seen significant reforms from South Africa’s National Treasury. For instance, any project below a R2 billion quantum no longer needs National Treasury’s sign-off. This is a welcome change as it means we can execute certain projects without unnecessary red tape.

Partnerships and policy decisions like these are crucial for igniting growth on the continent, and we see this first-hand in our work. Our partnerships with organisations like Meridiam demonstrate how public and private sectors can work together to unlock infrastructure investment.

These projects are practical examples of our comprehensive approach which grew from the recognition that governments simply cannot meet the infrastructure demands across the continent by themselves. As a financial services provider, our biggest contribution is to provide the relevant expertise regarding funding.

Rigorous due diligence is therefore an important pillar in the Bank’s process. We look at both qualitative and quantitative factors, bankability, commercial viability, and the impact of each specific project in terms of the United Nations Sustainable Development Goals.

In all our partnerships, we work with the right players, provide input based on our areas of expertise, and see ourselves as part and parcel of the economy.

Ultimately, our aim is to execute with speed and quality, because it will benefit our communities and economies. Africa isn’t just building roads and bridges; it’s paving the way to a more prosperous and connected future.

SDG 9:

Industry, innovationand infrastructure

Standard Bank focuses on making an impact in these two areas:

SDG Target 9.1

Develop quality, reliable, sustainable and resilient infrastructure, including regional and trans-border infrastructure, to support economic development and human well-being, with a focus on affordable and equitable access for all.

SDG Target 9.3

Increase small enterprises’ access to financial services, including affordable credit, and their integration into value chains and markets.

5

FACTS ABOUT AFRICA’S DIGITAL INFRASTRUCTURE

71%

How much underwater-cable bandwidth was used by cloud service providers like Google, Amazon, Meta and Microsoft in 2023

Where digital skills are most needed

These sectors will benefit significantly from greater digital literacy and skills:

• Agriculture

• Industry

• Services

1.38%

How much the GDP of low and middle income countries could increase for every additional 10% increase in broadband penetration

Internet is getting faster

Google’s 15 000 km Equiano undersea cable running along Africa’s west coast will increase internet speed five-fold in Nigeria and threefold in South Africa and Namibia.

Sources: Digital Infrastructure in Africa (2023), UN Economic Commission for Africa; and The Digital Transformation Strategy for Africa (2020-2030), African Union